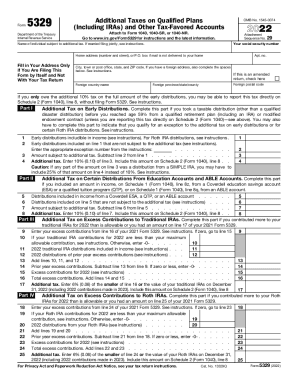

IRS 5329 2023-2024 free printable template

Get, Create, Make and Sign

How to edit 5329 tax online

IRS 5329 Form Versions

How to fill out 5329 tax 2023-2024 form

How to fill out form 5329

Who needs form 5329?

Video instructions and help with filling out and completing 5329 tax

Instructions and Help about irs form 5329

Hello my name is Katie sonorous with sonorous Wealth Management and in this video we're going to talk about how to fix you missed our MD let's get going I always impose penalty of 50% of your Mr. MD amount but in most cases if you have good costs IRS will waive the penalty the steps that you have to take in order to get relief from IRS for the payment of the 50% penalty are the following first step number one you have to take out your Mr. MD as soon as possible first thing as soon as you discovered their mission you have to do it on top of that you have to remember to take separate checks for different years say it's the end of 2019 you still have to take your 2019 distribution, and you realize you forgot to take distribution for 2018 in the month of December you can take to distribution one for 2018 that you missed and one for 2019, but they have to be separate checks it's very important because you have to include the check for 2018 with your explanation that you're going to be sending to IRS next...

Fill tax form 5329 : Try Risk Free

People Also Ask about 5329 tax

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 5329 tax 2023-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.